My last post, The Case For A Bond Bounce, laid out the case for a bond bounce amidst a painful decline following another hotter-than-expected inflation report. As it turns out, a bounce has indeed occurred. Largely driven by the factors I suspected. Now, the question becomes, how long might this move last, and how far might it go?

First, let’s revisit what I considered catalysts for the bounce we now see.

The Federal Reserve struck the dovish tone most expected. After all, going into the meeting, the market had done a fair amount of the heavy lifting for them, as the 10-year approached 5% on the heels of hotter-than-expected inflation reports. The Fed did not take cuts off the table this year and pushed back hard against the idea of additional rate hikes. Most importantly, the Fed announced its plan to reduce the pace of QT. More on that in a bit. The market is now looking to September as the Fed’s first rate cut. (Personally, I’m skeptical, but time will tell.)

Another factor I mentioned in my last post, the BOJ (Bank of Japan), did intervene to defend the Yen as the currency tested multi-decade relative lows. This move was widely expected and indeed happened. This served to strengthen the Yen against the dollar, which created downward pressure on US Yields.

Lastly, I mentioned Utilities as an interesting development. Utilities also provided clues that US Yields wanted to move lower, and in fact, utilities have broken out big time. In my last post, I was waiting for confirmation of the breakout above $66, which is now confirmed.

And plotted with the 10-year yield.

XLU-Blue, TNX(10-year yield)-Orange

The unusual relationship between equities and bonds I previously described remains. Equities and bonds remain positively correlated, which is not a normal occurrence and is not something I would expect to last, but for now, it remains.

SPX-Blue, /ZN 10-year Bond Futures-Orange

Equities

Was the most recent pullback a garden-variety correction or the start of something more? So far, it appears to be the former, a garden-variety 5%-10% correction. Assuming the current equity/bond relationship remains, some positive forces are coming into the market that could propel the bounce even higher.

The Reverse Repo facility has recovered from its recent lows. This provides liquidity that could enter the equity and treasury markets, supporting the rally.

Another liquidity boost will come from the Fed. The most important development from the May Federal Open Market Committee (FOMC) meeting was the announcement that the Fed will slow the pace of Quantitative Tightening (QT) beginning next month. The pace will slow by $ 35 billion, allowing the Fed to “reinvest” up to $35b in maturing assets back into the treasury market. This will largely serve to absorb additional supply and ensure treasury market stability.

Additionally, the window opens once again for stock buybacks to commence. Corporations have been the net buyers of stocks for years, and this trend is set to continue. Apple recently announced its largest stock buyback to date. These buybacks push the company’s stock prices higher and, depending on the degree to which the companies are weighted in the indexes to which they belong, push index prices higher as well.

Bond Technicals

The 10-year Treasury bond has quickly retraced to find itself at an inflection point, the confluence of two trendlines. Both the downtrend and the horizontal trendline lie ahead.

Conversely, the 10-year Treasury yield is falling to approach similar support levels. ( as you would expect)

In February, I drew up a few potential paths for a 10-year yield.

So far, its yield has reached the bottom of the gap and met resistance. While I’m not sure how much conviction I have at the moment for a 10-year yield to fall below 4%, here are a few possible routes I see moving forward.

The next few inflation reports will obviously influence yields in the intermediate term. Over the course of next week, I wouldn’t expect anything but chop. The market is likely in a wait-and-see mode ahead of next week’s inflation report (CPI).

Conclusion

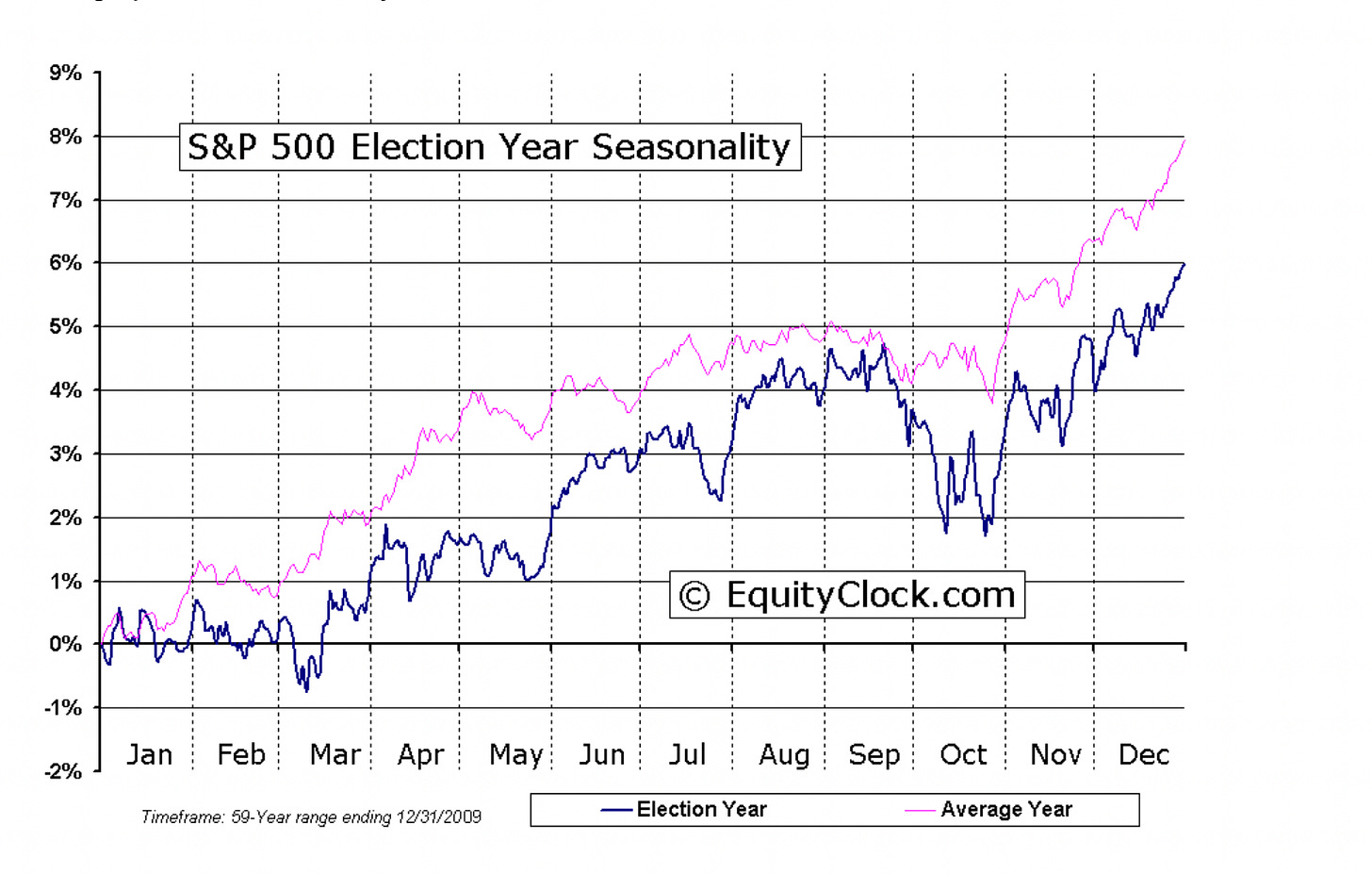

While the argument that the set-up for a continued rally in bonds makes some sense, with increased liquidity, the Fed coming back to the treasury market, a Dollar that may give back a little relative strength, and technicals that suggest there may be a little more room in this rally, the other side of that coin is that we are currently heading into a seasonally weak period for markets.

Traditionally, weak equities would produce lower yields. Tradition seems to be on hiatus; as I have pointed out, equities and bonds have been positively correlated in recent months. In that case, weaker equities would be a headwind for bonds and a lift for yields. That’s what I expect over the coming weeks. Lower equities, lower bonds, and higher yields. However, chop seems to be the name of the game this week. That chop just might produce a quick move lower in yields, especially prior to CPI. Any such move would be a gift and one to act quickly on to lock mortgage rates for clients still floating.