The Unthinkable Steepener

What Many in the Mortgage and Residential Real Estate Industry May Not Be Considering

All eyes are on the Federal Reserve, and grown professionals gossip like schoolchildren about the next monetary policy move. As we approach the next scheduled Fed FOMC meeting, speculation ramps up about the Fed's next move and its possible effects.

While the growing consensus is for the Fed to set the table for a rate cut in September, most assume that means rates along the curve will fall with Fed cuts. While that makes sense, it is not at all guaranteed. As a matter of fact, I think I can make a decent case against it.

First, here is a quick recap of the current narrative; it’s a simple one: The Fed begins cutting its benchmark Fed Funds rate sometime this year, and interest rates and mortgage rates follow suit. As the Fed Funds rate falls, rates along the yield curve fall with it. This would bring the cost of borrowing down for all. Things like mortgage rates would follow suit in this scenario.

Not only would mortgage rates fall, but the spread between the risk-free rate (government debt) and mortgage rates would begin to narrow, making mortgage rates even more attractive. Since the Fed began its hiking cycle, the spread between government and mortgage debt has ballooned above its historical norm. The difference between what the U.S. government pays “risk-free” on a 10-year Treasury (currently 4.17%) and the average 30-year fixed rate mortgage (currently 6.9%) is 273 basis points, or 2.73%. Historically, that spread is 175-200 basis points.

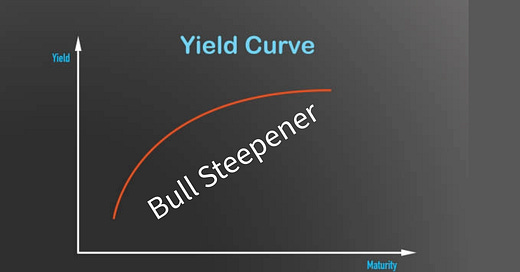

What is not widely considered is the risk of a “Steepener.” A “steepener” describes a yield curve that steepens when short-term rates fall while long-term rates stay elevated or move higher. This produces a steeper yield curve… or a greater spread between short-term and long-term rates. Hence, the term “Bull Steepener.”

How can this be? Long-term rates are affected by several things, including economic growth expectations, inflation expectations, and the supply of Treasurys. As more and more debt is issued, growth slows, and proposed political policies have an inflationary fragrance, it’s worth considering the possibilities of a Bull Steepener.

Looking at positioning in the 10-year treasury futures market, traders seem to be positioning for such an event.

The active 10-year Treasury futures contract shows a rising put/call ratio at 1.52 (anything above 1 signals a bearish sentiment). Additionally, traders seem to be positioned for an outsized move to the downside, well beyond one standard deviation, as 60% of puts are currently at the .40 delta or greater. Of course, we can’t know the whole story from this information, as traders could be hedging long positions or getting long via short puts, but this information is certainly a useful piece of the puzzle.

The technicals also suggest caution. Using the $TNX (10-year Treasury Yield), we see yield clearly bouncing off the established channel, along with a rising RSI(Relative Strength Index). I still contend that the open price gap at 4.8%, shown below in green, will be filled. This means yields will rise to 4.8% -5% in the coming months.

While we care to watch yield, I prefer to track bond price, via Treasury futures, as they are liquid and volume is easily measured. Given the active 10-year futures contract, it’s encouraging to see price break above the long down-trend. However, the wedge that has formed causes caution. I expect price to fall and re-test the breakout, but a failed re-test would likely produce a sharp sell-off in bonds.

Such a sell-off would be the fuel needed to fill the above-mentioned price gap, and it jibes with the idea that despite the Fed beginning to cut its benchmark rate, the long end of the curve is under no obligation to follow.