Priced For Perfection

Markets Have Again Priced An Aggressive Cutting Cycle. Will They Be Disappointed...Again?

The mainstream seems convinced of the coming refi boom, but I’m unsure. I’ve spent much time thinking about, researching, and listening to others regarding the idea that Treasury yields and mortgage rates are just beginning their downward slide. The more I dig, the more I listen, the more I try to put the pieces together, the more convinced I become that the path ahead will likely surprise those subscribing to the narrative that we are just beginning to see mortgage rates move lower. While historically the argument is sound, I find that the many distortions introduced into the market over the last five years have the power to nullify the historical argument. Remember, the same historical argument has been used for the past two years to argue that a recession is imminent. We are still waiting. Of course, recession will happen at some point, and it should, but it has sure been elusive. If recession remains elusive, the Fed will have but only one reason to cut rates as the market expects aggressively.

Liquidity

Let's talk about liquidity. Liquidity is the strongest case for the Fed to begin the cutting cycle now. One measure of liquidity over the past few years has been the relatively new Fed facility known as Reverse Repurchase facticity or, RRP. The RRP is used by banks to park excess cash at the Fed in return for overnight yield. At the height of pandemic money printing, more than 2.5T called the RRP home; now it’s less than $300mm. When I say cash, think liquidity.

Since the Fed began raising the overnight rate two years ago, the RRP has slowly been draining, as dollars chase higher and longer duration yield. Treasuries are among those higher yielding, longer duration instruments RRP has been chasing.

If, at some point, RRP runs dry, Treasuries will lose a source of support and the market will have lost a source of liquidity; it’s at that point that the U.S. Treasury and the Fed will have a problem. The choice will be to allow yields to rise, and potentially allow equities to fall, or once again embark on quantitative easing (QE). This is one of the only justifications I see for Fed rate-cutting at this moment. Liquidity is key to market health; as we witnessed at the onset of the COVID pandemic, illiquidity will sink markets quickly. A series of cuts would likely unlock liquidity, which would find its way back into equity and bond markets from things like money markets, which technically exist outside “the market”. Remember QE by any other name is still QE, and presumably not a path the Fed would like to venture down again unnecessarily.

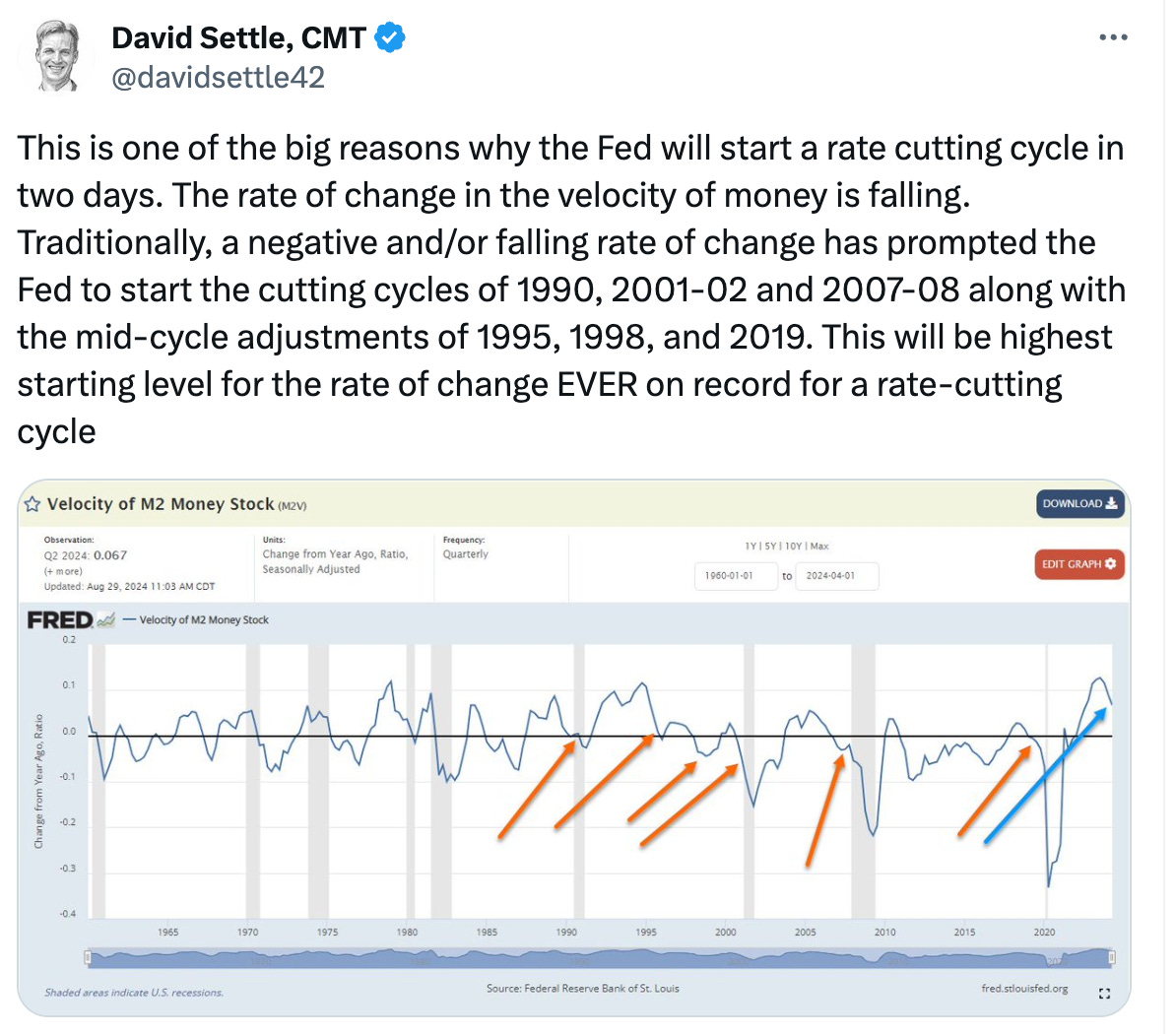

Another measure of liquidity is “M2”, a measure of the U.S. money supply, which has also been steadily declining. As pointed out here, declining M2 has been a precursor to past cutting cycles, but this time around M2 is positive, and at its highest level to start a cutting cycle. (P.S. I’ve followed David’s work for years, he’s a fantastic follow).

Why Cut?

When you step back and focus on the data, that economy seems to be in a decent place, and equity markets agree. While the economy continues to give some mixed signals, there is plenty of evidence pointing to an economy that is humming along, not in need of the Fed teat. As mortgage professionals we want lower rates, for obvious reasons, so it’s easy to talk ourselves into WHY rates should be lower. However, let’s do our best to set that aside, and take a 30,000 foot view of the entire puzzle, not just the pieces that may immediately benefit our industry. I think, if we do that, we see a different picture.

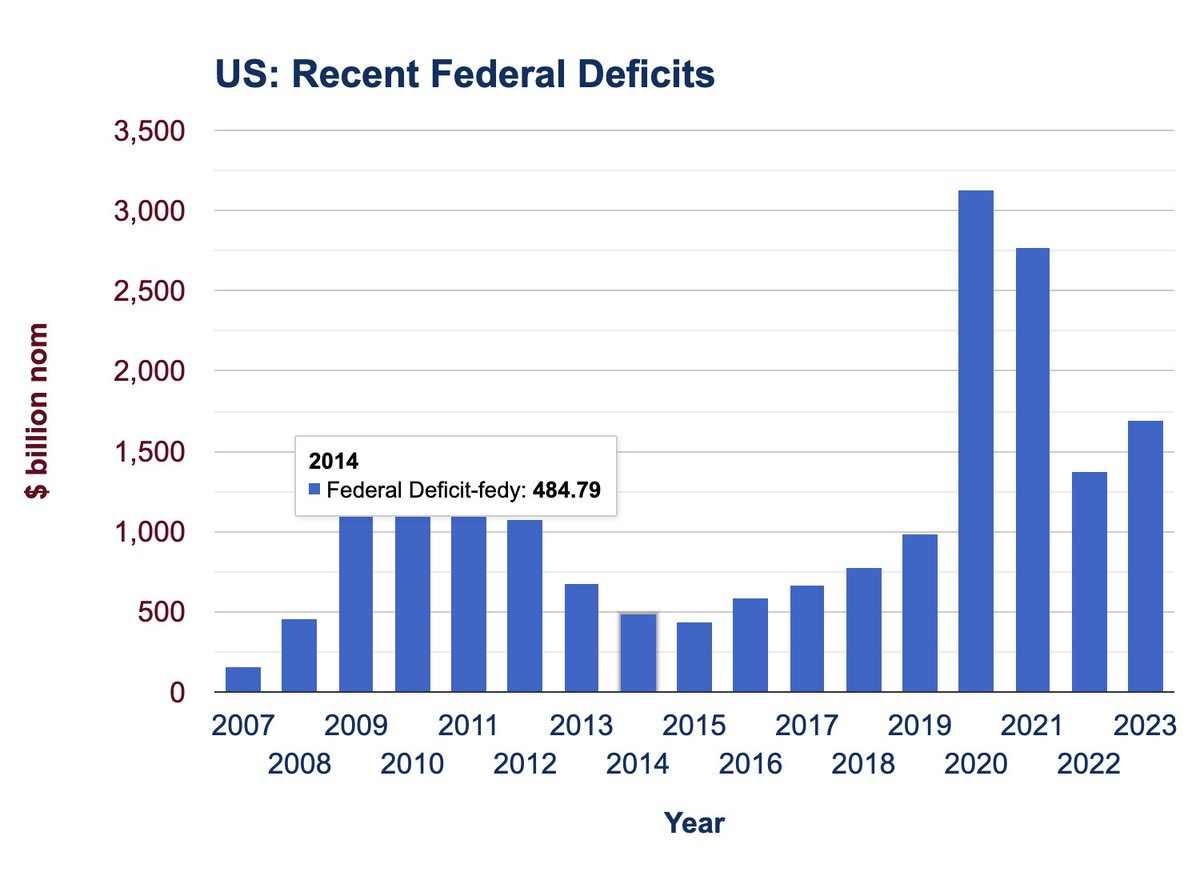

Deficit Spending

If one thing has become non-partisan in the U.S., it is deficit spending. Deficit spending continues to inch back toward the heights of the COVID pandemic. Deficit spending supports markets, and the economy, but also puts upward pressures on inflation. As long as the spending continues, markets and the economy will continue to benefit in the near term. However, as the deficit continues to mount, investors will likely demand higher and higher yield on U.S. debt.

Equity and Credit Markets

Equity markets again printed all-tim e highs this week, and one shouldn’t be surprised if new all-time highs print into year’s end. After all, such market action is historically typical in election years.

To the same point, credit spreads remain tight and healthy, also a sign of a healthy market. As a matter of fact, JNK 0.00%↑ , touched all-time highs earlier this week. The ETF $JNK is a commonly used proxy for credit spreads and market appetite for high yield (more risky) debt. In times of market stress, ETFs like this are often the first to show signs of stress. All-time highs don’t scream stress.

Employment

Despite all the recent noise, employment remains strong. The current unemployment rate of 4.2% is low by historical standards. Recently, there has been a great deal of debate over the data behind the employment figures. Certainly, there is some noise in the data and challenges measuring an influx of immigration in recent years, but the trend is undeniable - job creation has been strong. There is nothing more insulting than suggesting the Bureau of Labor Statistics (BLS) is somehow involved in a political conspiracy. Suggesting such things not only conveys a lack of understanding, but also political biases that, frankly, burns credibility with me. Again, stand back and look at the trends. The monthly average over the past 12-months is 200K, above pre-pandemic levels. I concede, these things can change quickly, and the recent slowing warrants a close eye, but there is no fire. Yet.

GDP

The U.S. economy, as measured by GDP, continues to perform well. By most accounts the potential of the economy is to grow 2% -2.5% annually, exactly where things are. As a matter of fact, only once in the past nine quarters has the economy grown below potential.

Inflation

The current read on inflation is encouraging, with the headline number for the Consumer Price Index (CPI) showing an annual growth of 2.6%, much closer to the Feds 2% target. The Fed’s “preferred measure” of inflation is the Personal Consumption Expenditures (PCE), which is similar to CPI, but measured in a slightly different way. The last two reads of PCE remain elevated from the May 2024 low, mostly due to insurance and shelter. Shelter has been a thorn in the side of anyone trying to call the top in inflation. I suspect it will continue to be that thorn.

I’ve argued for months that returning to the Fed’s 2% target in a straight line is unlikely. I suspect the 2% target will remain elusive to the Fed, who will eventually either change the way we measure inflation or move the goalposts altogether. With the possibility that inflation isn’t as whipped as many think, the Fed risks a policy error as rate cuts themselves are also inflationary, which would make that 2% target even more elusive.

Speaking of inflationary pressures, both major political parties in the U.S. are floating policies which will put upward pressure on inflation. From offering first-time homebuyers a $25K tax incentive, to increasing tariffs, and of course that continued deficit spending. All of these things are inflationary. That 2% target is looking more and more like a 75 yard field goal with a strong cross-wind. Unlikely.

Bond Markets - Priced For Perfection

The bond market has already aggressively priced in several hundred basis points in rate cuts. The 2-year Treasury yield is currently 3.6%, which tells us that the market has already priced at more than 200 bps in cuts from the Fed.

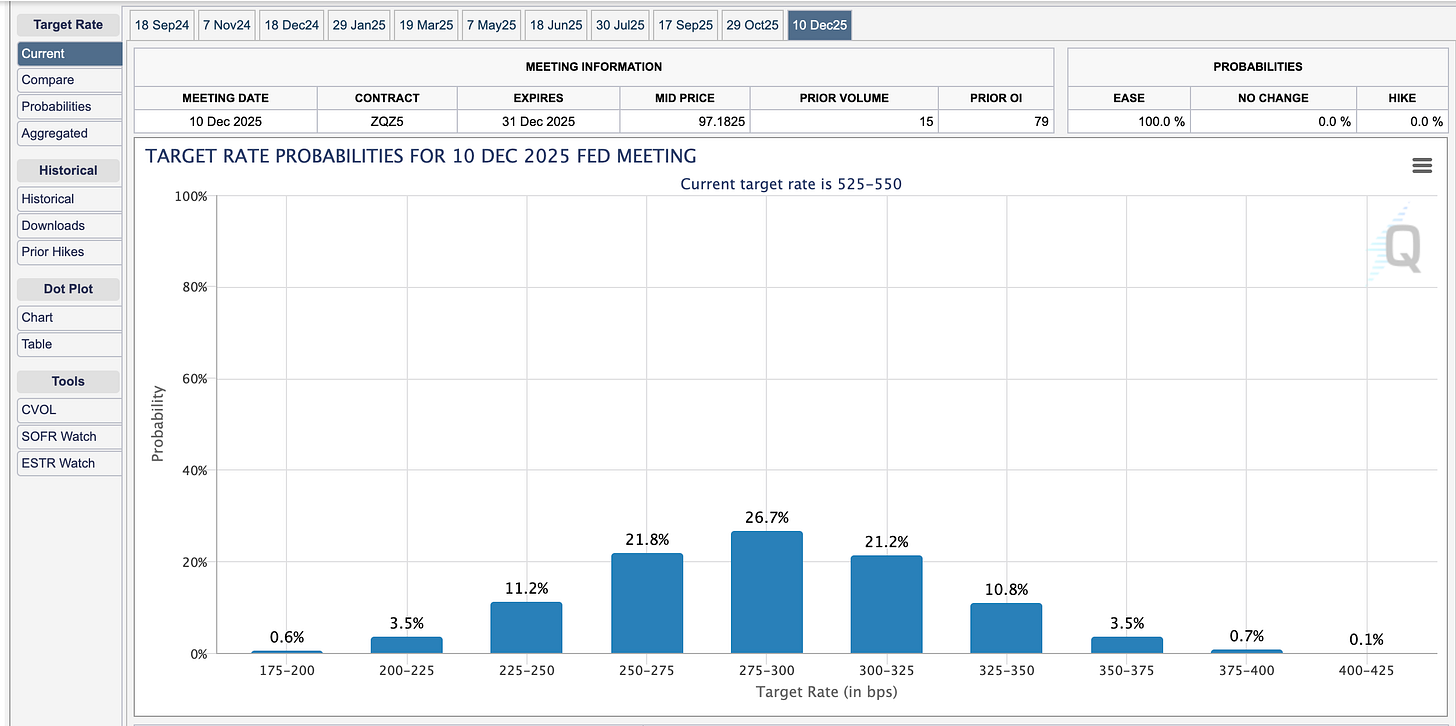

Fed Funds futures from the CME group suggest the same, more than 200bps in cuts over the next 15 months.

This implies two things. 1.) Yields ALREADY reflect cuts the Fed hasn’t made. Even if the Fed delivers 200bps cuts over the next 15 months, interest rates will remain largely unchanged, barring any additional stresses. 2.) Fed funds futures suggest a nearly 70% chance that the overnight rate will be 3% or lower in Dec 2025. If the 2-year treasury is to trade at a premium to the overnight rate, which it should, it tells me that the large majority of expected cuts between now and Dec 2025 are already priced in. If at some point market participants believe they have over-estimated rate cuts, and the pace of those cuts, i.e., inflation begins to show clear signs of bottoming and moving higher, yields will rise, and expectations will adjust. If, in fact, inflation was to reappear, it would create a real problem for the fed whose stated mandate is stable prices, but is also, in my view, trying to manage liquidity.

Conclusion

The Fed will almost certainly cut rates at the conclusion of its September FOMC meeting this week. Whether its 25bps or 50 bps is of little consequence, it’s the forward guidance that matters. Markets are priced for perfection. Fed Chair Powell has a tough job ahead of him. Not dovish enough and markets could reprice quickly to the downside, too dovish and markets could move sharply higher, like we saw in December of 2023. I presume Powell would like to see neither of those things.

Being a trader, I tend to believe in the idea of mean reversion. My expectation is the September FOMC event will be a “sell the news” event. Meaning the market will realize it may have become a bit too exuberant and bonds will move lower, yields higher by the end of the week. I think the low in mortgage rates may be in for the year. The timing makes sense, in addition to bond prices being a little “frothy” heading into the event, we have also arrived at what has been a seasonally challenging period for mortgage rates over the past few years.

The economy may be slowing but dosen’t appear to be stressed. What is concerning is dwindling liquidity, which I feel is the Fed’ss motive to cut. Watching RRP, M2 and other liquidity indicators will likely prove useful in the months ahead.