A Hawkish Fed Would Bring Lower Mortgage Rates

Markets and Data are Telling The Fed They Are making A Policy Error In Real-time.

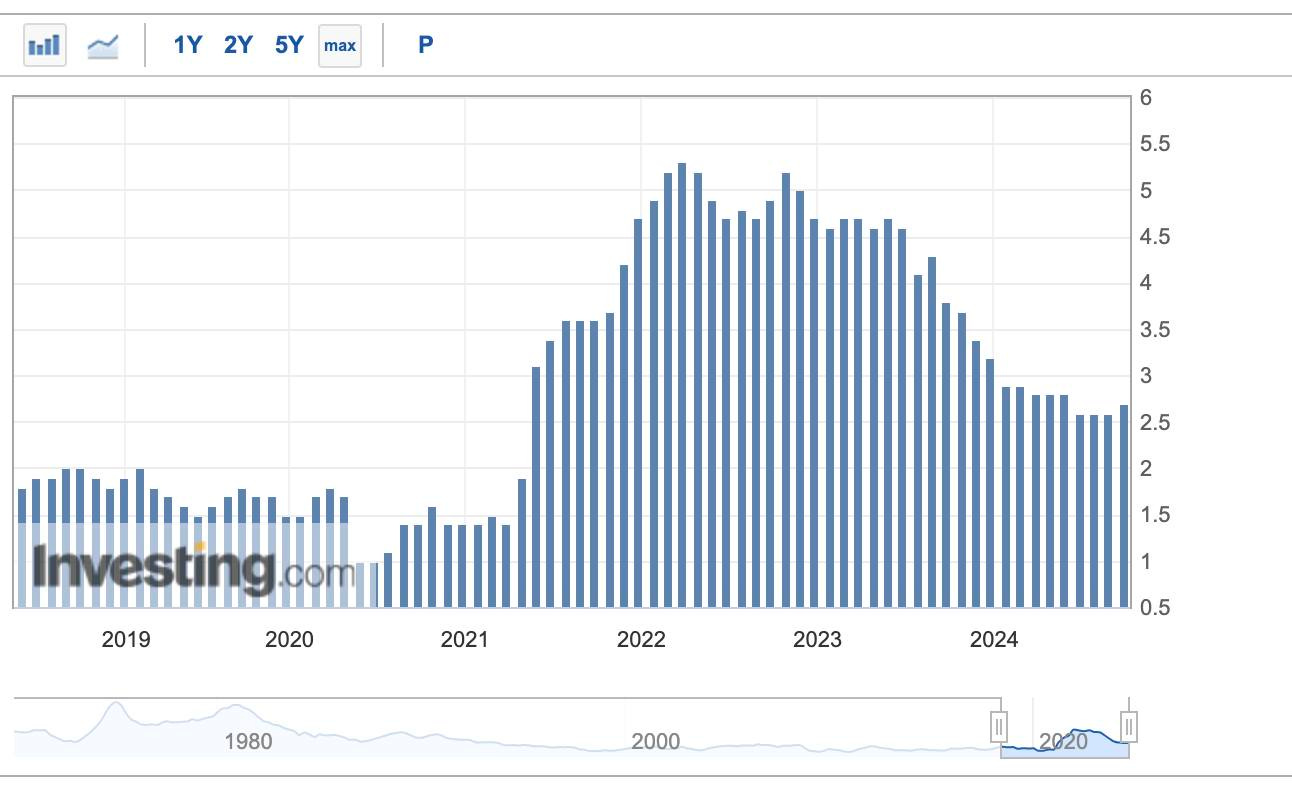

I’ve written many times here that I believe inflation will be sticky, and there is a strong possibility of resurgence. While the latter remains to be seen, the former has proven true. Inflation has improved significantly from its peak, but we are now six months on from any meaningful improvement. Moreover, the Core Personal Consumption Expenditures (PCE) price index has just marked its 42nd month above 2.5%.

I’ve been banging the table that the yield on the 10-year Treasury was likely to return to 5% before this bout of inflation is ultimately over. On September 18th, I called the low for mortgage rates in 2024; with just a few weeks left, that looks like a good call. And now, another prediction. It’s widely expected the Federal Open Market Committee (FOMC, aka The Fed) will cut its benchmark rate by another 25 bps this week. I’ll take this opportunity to surmise it will be their last cut. That’s right; the Fed’s hands will be tied in ‘25, and no additional cuts will be made to the Fed Funds Rate.

Not only do I think they won’t be able to cut in 2025, but I also don’t think they should consider a cut this week. The bond market, particularly the long end of the curve, has been telling the Fed for months that it is making a policy error. It’s no coincidence that the 10-year Treasury yield bottomed the day the Fed began its cutting cycle. The same day, I said we had seen the low in mortgage rates for 2024.

If you monitor the CME Fed Funds Futures tool, you know that market expectations for a 25bps cut following the next FOMC meeting are about as high as they can get.

It has been fascinating to watch how the Treasury market has consistently reacted to movement in the Fed Funds Futures. As the market becomes more sure of expectations for future cuts, the bond market does the closest thing it can to raising a middle finger: it sells off, pushing rates higher. It’s important to remember that just because the market expects a given policy, that doesn’t mean that the market prefers that policy. To say it another way, just because the market expects another cut doesn’t necessarily mean it agrees with the move.

The chart below shows Fed Funds Futures in blue and the 10-year Treasury Yield in red via the $TNX. While correlation is not causation, it is interesting that the move higher in yields began in earnest the same day the Fed cut by 50 bps in September, which was a deeper cut than most expected to kick off the cutting cycle.

So, let's discuss why the Fed should be D.F.N. (done for now) and pause its cutting cycle now, and why I don’t believe they will do anything in 2025.

First, unemployment remains around 4%. Not only that, but it is one of the most extended stretches below 4.5%. Yes, there are some underlying weaknesses, but the underlying trend is about 150K jobs added monthly - not bad!! At some point, hiring will slow; but remember, the Fed mandate is “full employment”, not never-ending high employment growth. There have been some data issues, and respondent levels on the establishment side have been horrendous. Also, immigration rates have been historically high in recent years but are now slowing.

GDP is well above 2%. As a matter of fact, many initial estimates for Q4 2024 GDP put it over 3%, and GDI estimates are now converging with GDP, lending confidence to the estimates. Stock markets have notched more than 50 all-time highs in the past year. Liquidity is ample. Credit spreads are very tight, at less than 300 bps between High Yield Corporate and risk-free rates. Alternative assets like crypto are also reaching record highs, which, to me, suggests not only ample liquidity but a risk appetite. Sure, these things disproportionately benefit the top of the income distribution, but that doesn’t make them any less factual.

We will set aside the what-ifs, many of which relate to the incoming administration’s policies and geopolitics. However, it is fair to say that these what-ifs carry far more risks of inflationary pressures than disinflationary pressures. Not many are talking about it yet, but there is a building argument that not only are the Fed’s hands tied in 2025, but it may be forced to raise its benchmark rate before the year is over!

I suspect the FOMC will cut an additional 25 bps in December so not to surprise markets. However, if the FOMC adopts a hawkish tone through the prepared statement, press conference, or the “Dot-Plot,” that will likely spark a bond rally. I don’t expect much hawkishness from the Fed at this point. I suspect the Fed will ignore the bond market as long as the equity market ignores the bond market. When equities decide yields are becoming a problem, the Fed will be forced to listen.